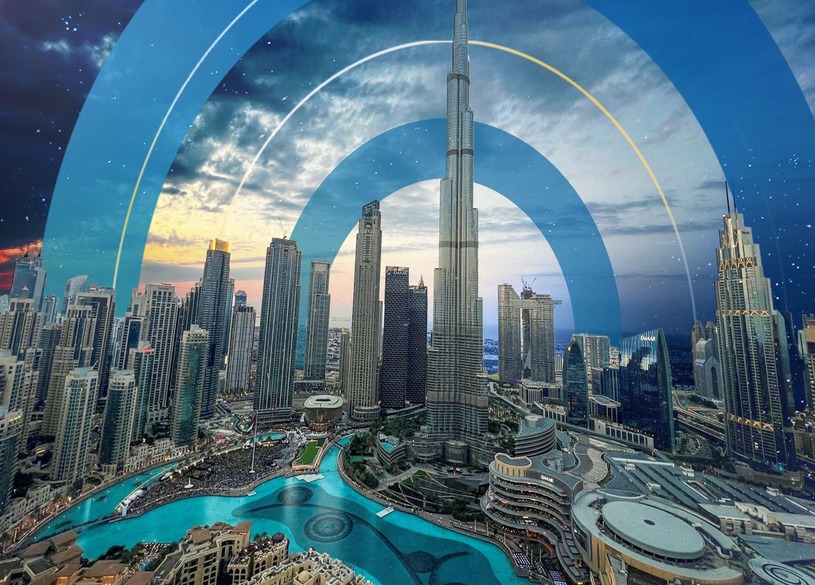

The real estate landscape in Dubai has witnessed significant growth, as per the latest findings from the ValuStrat Price Index (VPI). Let’s delve into the details of this burgeoning market.

Unprecedented Growth Across Residential and Commercial Sectors

Dubai’s real estate market, both residential and commercial, experienced remarkable expansion in the first quarter of 2024. The ValuStrat Price Index (VPI) serves as a reliable indicator, showcasing the fluctuations in capital and rental values of typical properties over time.

Residential Segment: A Flourishing Landscape

In the residential domain, the VPI for capital values surged by 6.4% quarterly and an impressive 24.7% annually. This surge propelled the index to 167.5 points from its base of 100 points in Q1 2021. Notably, mid-affordable communities emerged as the primary catalysts for this growth, with apartment valuations soaring by 5.7% quarterly and 20.1% annually.

Community Insights: Driving Growth

Analyzing the data further reveals that communities falling within the mid-affordable range played a pivotal role in this upward trajectory. Communities such as The Greens, Town Square, Al Quoz Fourth, Palm Jumeirah, The Views, Discovery Gardens, and Dubai Production City emerged as the top performers annually, showcasing impressive growth figures.

Resilient Villas and Office Spaces

Villas exhibited remarkable resilience, with a yearly gain of 29.6% and reaching a decade-high in prime villa values. Similarly, the office sector witnessed an astonishing upswing, with office unit valuations soaring by 29.9% annually, indicating a persistent demand for high-end office spaces.

Expert Insights: Haider Tuaima’s Perspective

Haider Tuaima, Director and Head of Real Estate Research at ValuStrat, emphasized the robustness of Dubai’s real estate market. He underscored the steady growth across residential, office, and industrial sectors, positioning Dubai as a premier destination for real estate investment in the region.

Prime Property Prices and Rental Trends

Prime property prices surged by 26.7% year over year and 7.3% quarter over quarter, setting a new high of 173 points. Desirable prime villas witnessed capital gains of 33.1%, reaching a new 10-year high of 211.8 points.

Rental Dynamics: Apartments vs. Villas

Asking prices for residential properties experienced a notable uptick, with apartments witnessing a 16.4% year-over-year increase in asking rent. Villa rentals, on the other hand, saw a modest rise of 1.3% quarterly and 6.1% annually.

Future Outlook: Anticipated Supply

Looking ahead, the market is poised for further expansion, with a total of 46,558 new build units anticipated to enter the market this year. Additionally, significant progress has been made in ongoing construction projects, with completion slated for 2028.

Conclusion

In conclusion, the latest insights from the ValuStrat Price Index paint a promising picture of Dubai’s real estate market. With sustained growth across residential, office, and commercial sectors, Dubai continues to solidify its position as a global hub for real estate investment. Contact us